The Swanlaab Manifesto

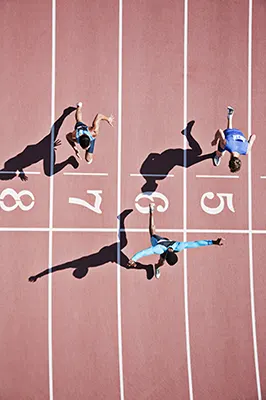

We believe in bold entrepreneurs, groundbreaking technology, and the power of collaboration to turn vision into reality.

We are more than just investors, we are partners in the journey, bringing capital, strategic expertise, and hands-on support to help founders navigate the complexities of building a high-growth company.

We invest in deep tech, B2B software, and agri-food innovation, backing entrepreneurs who challenge industries, disrupt markets, and scale with purpose.

We understand that fundraising is just the beginning, the real challenge lies in execution, growth, and long-term success.

We co-build, challenge, and push boundaries alongside the entrepreneurs we back.

- Smart Capital – Beyond funding, we bring insights, experience, and strategic vision.

- Operational Support – From scaling sales to refining go-to-market strategies, we help turn potential into performance.

- Global Mindset – With our roots in Spain and Israel, we connect founders to a worldwide network of investors, partners, and clients.

- Sustainable Growth – We believe in building resilient, sustainable companies that generate impact while delivering strong returns.

Because great companies are not built alone, and true success comes from vision, execution, and the right partners by your side.

Swanlaab – Scaling Visionary Companies

The Swanlaab Manifesto

We believe in bold entrepreneurs, groundbreaking technology, and the power of collaboration to turn vision into reality.

We are more than just investors, we are partners in the journey, bringing capital, strategic expertise, and hands-on support to help founders navigate the complexities of building a high-growth company.

We invest in deep tech, B2B software, and agri-food innovation, backing entrepreneurs who challenge industries, disrupt markets, and scale with purpose.

We understand that fundraising is just the beginning, the real challenge lies in execution, growth, and long-term success.

We co-build, challenge, and push boundaries alongside the entrepreneurs we back.

- Smart Capital – Beyond funding, we bring insights, experience, and strategic vision.

- Operational Support – From scaling sales to refining go-to-market strategies, we help turn potential into performance.

- Global Mindset – With our roots in Spain and Israel, we connect founders to a worldwide network of investors, partners, and clients.

- Sustainable Growth – We believe in building resilient, sustainable companies that generate impact while delivering strong returns.

Because great companies are not built alone, and true success comes from vision, execution, and the right partners by your side.

Swanlaab – Scaling Visionary Companies