As B2B investors, we are as passionate with B2B Sales as you are. We know how hard it can be to build and automate a Sales Engine for predictively and recurrently generate quality leads for your business.

We also aware about the rush you feel after closing for first clients. For a founder, the pride is enormous. You’ve been able to put together a great founding team, built a product out of scratch, maybe raised some funding and, after all the uncertainty, sweat an tears from the start of the journey, you finally did it. You’ve got your first customers!

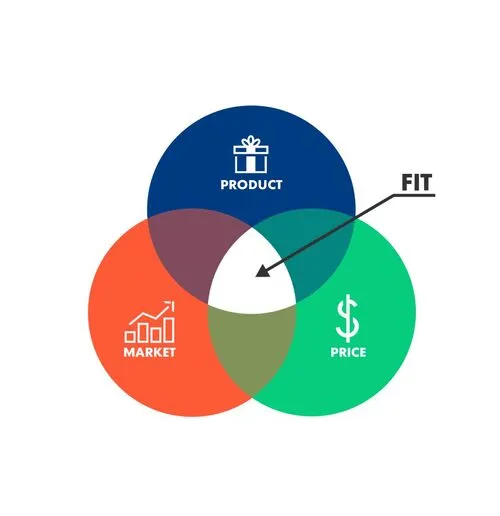

From your point of view, onboarding well-known shinning logos can be something unique, extremely valuable and the start of a long-term relationship. Product-market fit seems clear. However, do those companies think the same about your product? Well, that’s exactly what we, as investors, think when seeing those logos in your deck. Let’s deep dive on this.

Who is using it?

Change isn’t easy, and businesses don’t undertake system modifications and new implementations just for the fun of it. If there’s no real problem the comapny is trying to solve, there’s no real reason for them to make the effort.

Quite often we hear things like “We have clients like Yellow Bike, Orange Oil, Purple Taxi and a Red Bank using our product”. That’s sounds amazing and will make investors move slightly from the chair, but, who is actually using it within those companies? Depending on the answer, investors will either jump off the chair our lay back again.

Statements like these are great for obtaining new prospects. It will give future clients the confidence that if these kind of logos trust your solution there must be something worth taking some time and that, at least, you’ve got an interesting product.

From an investor view this is a whole different things. As you will know, decision making in large organizations are one thing and SMEs and startups are a another one. Let’s analyze both and divide them into sophisticated (for time-consuming enterprise sales) and not sophisticated buyers (for fast decision making sales). Sophisticated doesn’t relate to how smart these companies are but to how complex (and long) their decision making process works in acquiring a new product.

Sophisticated buyers

Sophisticated has to different meanings. It could be either “having a great deal of worldly experience and knowledge of fashion and culture” or “high degree of complexity”. Although we could be talking about selling to Sotheby’s or Louis Vuitton, were are actually referring to the second meaning. Long, tedious, complex and exhausting processes defining sophisticated buyers, nothing to do with fashion and culture (although they often wear nice shoes!)

These kind of buyers are the ones often regarded as Enterprises, due to their usual size and complexity. However, they can also be scale ups or even Public Administrations!

There are three things these clients have in common:

- If the acquire your product, they will have taken a look (and maybe tried) at every single alternative in the market.

- They require complex onboardings and system modifications to adapt your product due to their legacy systems and complex processes.

- Their decision making process goes through different players inside the organization. It’s unusual to talk directly to the decission maker in your first touchpoint.

At this point you might be thinking: “Wow, having one of these will absolutely prove my product-market fit, Yellow Bike and Orange Oil can’t be wrong”. Well, as most things, it depends.

We, as investors, we will focus on things like:

How much is your sophisticated client paying?

If your client if paying a little amount, let’s say €100/month, it will seem, from an investor perspective, that this looks like a Proof of Concept (POC) or Pilot Test. Why? Because these kind of clients only have great budgets to solve great problems. Since implementation and adoptions of your software take so much time and effort, it’s complicacted for them to go “all in” before trying your product out with a small team or using just a couple of easy to adapt features.

For Orange Oil or Purple Taxi, paying €100/month is just a preliminary small-scale study conducted to assess how useful the solution is for tackling their problem. Since €100/month is literaly nothing for them, they usually try out a lot of different products every year. However, it’s a great first sign for investors since them trying out your product means they believe it’s, at leats, among the best solutions in the market. Maybe it’s the start of a multi million dollar long term relation!

Also, if Orange Oil or Red Bank pay just €100/month, what Business Model would that be? How much would a small startup or SME pay? €5/month? With such a long process to sell to these sophisticated clients, €100/month would be a terrible bussiness model difficult to scale.

Who is using it?

Even if the amount paid by the company seems relevant, lets say €5.000/month, to distinguish between a POC and a real client we, as investors, will also check who inside the company is using it. If only a small, not core team is using it, the stickiness will be really weak, since they can very easily stop using the product. Never forget what €5.000/month will mean to Orange Oil or Red Bank…probably not much and not many C-Level Executives will even be aware.

However, if it’s being used by the vast majority of the teams inside a company, it will be a clear sign that the implementation is taking place. The company is slowly adopting and starting to feel the advanges of the product.

We, as investors, will obviously take this a great sign and these type of logos look amazing in websites for atracting new, less sophisticated clients. However, our focus is in thinking about how big this can be and how well you’re able to convince this sophisticated customers.

Disclamer

To add a final ingredient in what a real sophisticated client is we must also consider that, although a client might be sophisticated in its buying process, it might actually be not really sophisticated in tech. To really, really know we must ask the question: “why did you chose this product?” If the answer is something like: “we tried this problem in these 3 different ways and finally realised we needed this kind of product and compared it with 2 different alternatives”. Then, this is a really sophisticated client and, apart from having an long, exhausting buying process, their selection of tech is also really interesting to consider. Product-market fit looks very promising.

Not Sophisticated

Fortunately, not all clients have long and exhausting decision processes. Actually, the vast majority of them have pretty straightforward ones.

As you can imagine, there is a lot of grey inbetween the most sophisticated ones like Red Bank and the less like Icecreams Madrid. When exemplifying something like this, it’s always easier to understand thinking about the extremes. We’ll keep on like that for this section.

For the not sophisticated ones, let’s think about both Startup Rocket that just raised €1,5M in a seed round and Icecreams Madrid, a SME that ones to finally digitalise after more than 60 years. In both cases, reaching the decision maker seems quite doable and not too challenging. They will also use the product for the whole company, integrating the software completely since the very beggining, no time for POCs.

Here, our questions to the company would be:

How did you find out about the product?

Not being sophisticated doesn’t mean that the client is naive. They’re actually risking much more than the C-Level executive buying the product as if affects a larger percentage of their budget and probably can’t make much mistakes while investing money in your product.

However, it’s interesting to understand how did they found out about the product and what pushed them to use it. There are four scenarios here, ranked from best to worst:

- They found out about the product after doing online research and referrals

This is the best scenario because it means that, although they’re process isn’t exhaustive and complex, they have “done their homework” and analyzed the market. Although they might have not tried out every single product in the market or done several POCs with diffferent alternatives, there is a clear sign of product-market fit. The decision has been properly analyzed.

- They chose the product because they had already realized they had a pain and, after being reached out, realized it could be a good solution.

This could be either a great scenario or actually a not so good one. If after being reached out and having identified their pain they decide straight away to go with the product, it means two things: your sales team is great, but the client can churn at any time. At soon as they realize that other alternative products exist, they can perfectly switch from yours to another. For investors this kind of clients wouldn’t be a sign of clear product-market fit, although it does show that there is a pain and a market.

- They had a personal connection with the founders of the company

It’s quite obvious this isn’t escalable so, although it’s great that your Business Angels, Advisors and close entrepreneurial friends allow you to do POCs with them, it doesn’t show product-market fit. However, this will definitely be great way of having interesting feedback!

Conclusion

Although you can perceive that having as much logos as possible is great, you shouldn’t be deceived by them. Having strong product-market fit can be identified after your clients deep dive into their pain and possible solution and still choose you. Don’t focus on winning as many companies as possible, but rather focus on solving their problems as best as possible.

You can find yourself losing plenty of time onboarding and negotiating with new clients to suddenly realize they churn and easily switch to other alternatives. Deep dive into their problems and collect as much feedback as possible from day one.

We, as investors, try to find out why did those clients chose you to find if your product-market fit is real or whether your marketing, sales or network is just amazing. We really hope it’s actually the two cases at the same time. In order to build the best product, put on your “investor suit” and try to find out too! The question is: Is your product a Must Have or a Nice to Have?